Does Consumer Legal Funding Put Consumers in Debt?

There has been a lot of discussion if Consumer legal funding is a loan and thereby creates debt for a consumer Consumer legal funding, sometimes called litigation funding or lawsuit funding, provides cash upfront to plaintiffs, to be used for household needs, which are involved in legal proceedings in exchange for a portion of the eventual settlement or judgment. It doesn’t create debt like a loan from a bank or credit card, these distinctions contribute to its classification as a unique financial product rather than a loan or debt.

- Non-recourse nature: Unlike loans, where the consumer is personally liable for repayment regardless of the outcome, consumer legal funding is non-recourse. This means that if the plaintiff loses their case, they are not obligated to repay the funding. The repayment is contingent upon the success of the lawsuit.

- No monthly payments: In a loan, borrowers usually make monthly payments to repay the principal amount plus interest. With consumer legal funding, there are usually no monthly payments required. Instead, repayment only occurs if and when the case is settled or won, and the repayment is often structured as a lump sum.

- Risk sharing: Consumer legal funding providers assume a significant amount of risk by providing funds to plaintiffs who may not ultimately win their case. Unlike lenders who typically assess creditworthiness and require collateral, consumer legal funding companies evaluate the strength of the case and base their decision on the likelihood of success and not the creditworthiness of the consumer.

- Not regulated as loans: Consumer legal funding is often subject to different regulations than loans. While loans are typically governed by banking and lending laws, consumer legal funding has its own set of regulations that ensures consumers are protected and the product is offered in a responsible manner.

Some of the other key differences between consumer legal funding and debt from a loan is in how repayment works. With a loan, the consumer borrows money and agrees to repay it with interest, regardless of the outcome of the situation, creating debt. However, with consumer legal funding, repayment is contingent upon the success of the case. If the consumer loses their case, they will not have to repay the funding. But if they win, they will have to pay back the amount funded, with fees that are known upfront.

So, therefore consumer legal funding doesn’t create debt. Unlike Consumer legal funding, some loans can put consumers in a cycle of debt.

The term cycle of debt refers to a pattern where individuals or households become trapped in a recurring pattern of borrowing money to meet financial obligations, only to find themselves in even greater debt over time. This cycle often involves:

- Initial Borrowing: The cycle typically begins with an initial borrowing of money, such as taking out a loan, using a credit card, or obtaining other forms of credit to cover expenses or emergencies.

- Accumulation of Interest and Fees: As time passes, the borrower may struggle to make timely payments on their debts, leading to the accumulation of interest charges, late fees, and other penalties.

- Financial Strain: The increasing debt burden can put a strain on the borrower’s finances, making it difficult to cover basic living expenses and other financial obligations.

- Additional Borrowing: To address their financial difficulties, borrowers may resort to additional borrowing or using high-cost forms of credit, such as payday loans or cash advances, to make ends meet.

- Repayment Challenges: The cycle continues as the borrower struggles to keep up with mounting debt payments, leading to further financial stress and the need for more borrowing.

- Escalating Debt: Without significant changes in financial habits or circumstances, the debt continues to escalate, with the borrower owing more money than they can realistically repay.

Breaking the cycle of debt often requires proactive steps such as budgeting, reducing expenses, increasing income, seeking financial counseling, and finding ways to pay down debt strategically. It may also involve negotiating with creditors, consolidating debts, or exploring debt relief options such as debt settlement or bankruptcy.

Consumers who use Consumer legal funding are never placed in a cycle of debt. Consumer legal funding has many other positives to a consumer besides not placing them in debt.

- Immediate Financial Assistance: Consumer legal funding provides plaintiffs with immediate cash to cover living expenses, medical bills, legal fees, and other costs associated with their lawsuit. This can be particularly helpful for individuals facing financial hardship due to their inability to work or other circumstances related to their legal case.

- Non-Recourse: Consumer legal funding is non-recourse, meaning that if the plaintiff loses their case, they are not obligated to repay the funding. This reduces the financial risk for the plaintiff, as they only repay the funding if they win their case.

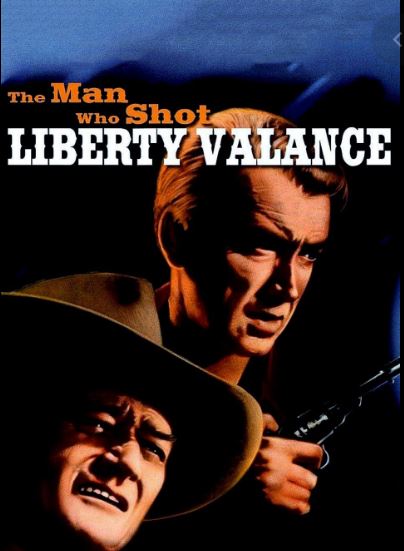

- Leveling the Playing Field: Consumer legal funding can help level the playing field in legal disputes by providing plaintiffs with the financial resources to pursue their case effectively. This is particularly beneficial for individuals who are up against well-funded defendants or corporations.

- No Upfront Costs: Unlike loans, consumer legal funding does not require upfront payments or monthly repayments. Instead, repayment is structured with a known outcome and amount.

Overall, consumer legal funding can be a valuable resource for plaintiffs in need of financial assistance during legal proceedings without putting them in debt.