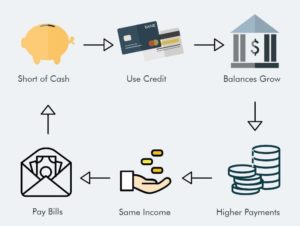

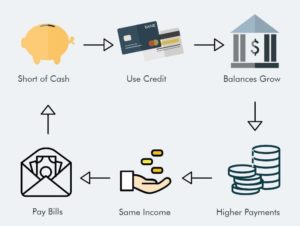

But with 73% of us living paycheck-to-paycheck, it’s something that is oh so easy slip into.

And a cycle of debt can be crippling, not only because of the continued bite it takes out of your paycheck, but because it can put you one illness, accident, or job loss away from badly damaged credit, collections, and even bankruptcy.

That’s why using a credit card can be so dangerous if you don’t have a guaranteed, steady, and robust income.

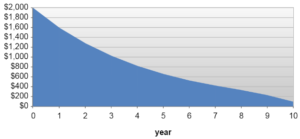

Here’s an example:

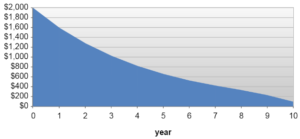

Say you take out a credit card with 26% interest and charge $2,000. If you make the standard 4% minimum payment—$80 every month—it will take you 10 years and 6 months to pay off in full.

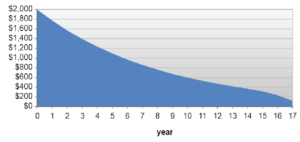

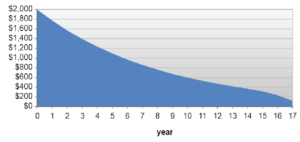

Another example:

You have credit card with 36% interest and charge $2,000. If you make the standard 4% minimum payment—$80 every month—it will take you a whopping 17 years and 9 months to pay off in full.

Now, that’s IF you can make the monthly payments in full EVERY MONTH. Sometimes that is a hard thing to guarantee.

Accidents, for example, can cause injuries that can threaten a person’s ability to go to work and earn a living as they usually do. Some people just need time to recover, others need surgery. Still others are injured permanently and need to either change careers or are unable to work at all.

And being compensated after an accident can take time. The more severe the injuries, the longer an insurance or legal claim is likely to take to reach a settlement.

That leaves people in a bind, and unable to make ends meet.

According to a recent Harris Poll survey, 62% of Americans would struggle to meet BASIC HOUSEHOLD NEEDS without 3 months of income.

So what do you do? Put it on a credit card?

Maybe, but that can be very dangerous if you’ve been in an accident, are pursuing a legal claim, and don’t have regular income. One missed payment and can damage your credit and put you on the road to bankruptcy. People often take out loans to pay off other loans, creating a cycle of debt.

That’s why maintaining access to consumer legal funding is so important.

Consumer legal funding gives people a choice to replace lost income now by selling a small part of their future anticipated recovery. Because it’s a purchase, it doesn’t create debt, isn’t connected to consumer credit, and can never put someone in collections or bankruptcy.

There’s no monthly payment, which is great when there is no other income coming in. And all costs are spelled out in dollars and cents—no interest calculations. All payments come from the settlement, so if something goes wrong with a case, nothing has to be paid back—even the funding. Nothing.

It’s a product specifically designed to help people in this situation, and something that is much safer for consumers than putting expenses on credit cards.

People should have options to avoid cycles of debt. Consumer legal funding is one of those necessary options.

Source: Credit card payoff calculations made with Bankrate.com’s online calculator.